In an era where corporate sustainability takes center stage, the adoption of solar energy is swiftly gaining momentum. Embracing solar power not only allows businesses and homeowners to reduce their carbon footprint but also offers a gateway to significant financial advantages. In this cutting-edge guide, we delve into the top three solar financing options available to businesses in 2023.

Discover the intricacies of solar financing, uncover the most suitable options for your space, and navigate the path to an environmentally conscious and economically sound future.

How does solar financing work?

Before investing in solar, it is essential to evaluate all options to best meet the energy goals and maximize ROI.

3. Solar Leases & Power Purchasing Agreements

Solar installations can be rented through solar leases or power purchasing agreements (PPA). Solar leasing makes the switch to renewable energy more attainable for some customers. Unlike purchasing solar panels or using payment plans, leasing solar panels means they are owned by a third party who is ‘renting’ them out.

In a traditional PV lease system, businesses and homeowners pay a fixed monthly fee to solar companies. Through solar leasing, the solar developer maintains ownership of the panels and the electricity produced, renting out the equipment each month.

In a Power Purchase Agreement (PPA), homeowners can adopt solar energy without the need to own a PV system. Instead of renting the PV system, buyers purchase electricity generated by the solar panels at a discounted price. This electricity can be obtained from an entity or company that owns and operates a renewable energy system, such as a solar or wind farm. Homeowners enter into a contract with this entity to buy the electricity generated by the renewable energy system at a predetermined rate over a specified period of time.

It’s essential for businesses and homeowners to carefully evaluate their financial situation, energy needs, and long-term plans when considering solar leasing or PPAs. Consulting with solar providers and understanding the terms of the agreements will help make an informed decision that best suits their specific circumstances.

2. Solar Loans

Paying for the upfront cost of solar panels in one transaction is not an easy task; hence, solar financing makes new system installations accessible by reducing the upfront pressure of cash payments. The financing typically involves loans with a payment period set between 10 to 20 years, and the monthly payment method is available through banks, lenders, and solar financing companies. This approach has been one of the earliest and most preferred ways to pay for solar installations.

Solar loans generally come with fixed interest rates, and while the financing options can span for decades, there are also short-term loan arrangements available. These various options can be explored independently or in collaboration with PV installers. Aside from personal loans and financing options, PV systems may also qualify for home equity loans and home equity lines of credit.

If businesses and homeowners with good credit choose solar loans, they can immediately add value to their property. Despite higher interest rates, some loans have little to no money down. Additionally, certain loans not only offer a low-fixed interest payment but also make federal Investment Tax Credit (ITC) and local incentives applicable.

1. Cash Payments

Cash payments are the quickest way to reach a break-even point without the need for monthly payments. This indicates that the system price is equal to the costs of the utility electricity avoided.

Through cash payments, businesses and homeowners will have full ownership of the system and the electricity it produces. To reduce the initial cost of the system, cash payers can qualify for different incentives and rebates. For owners with higher tax liability, cash is the best way to maximize long-term savings. It will allow systems to pay for themselves more quickly, without ongoing loan or lease expenses

Pros and Cons of Solar Financing Options

| Pros | Cons | |

| Leasing Solar Panels | Allows low-income families to support clean energy | Doesn’t increase house value |

| No down payment | No eligibility for solar tax incentives | |

| Little to no maintenance is required | Can come with a cancellation fee | |

| Solar Loans | Minimal money is required upfront | Need to pay interest on the loan |

| Boosts your property value | Prolong solar payback period | |

| Eligible for tax credits | Paying more for the system over time | |

| Cash Payments | Lowers the overall cost due to no interest | High upfront costs |

| Allows immediate savings | Lower purchase protection | |

| Boosts home value | No points or cashback for purchase |

Maximize ROI with Solar Financing Options

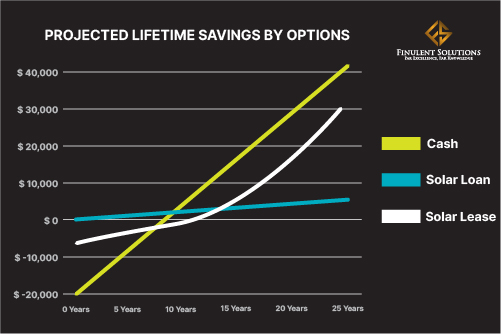

In the U.S., the average ROI is about 10%, while in other countries, it is around 20% or more; this percentage can change depending on the country.

A positive ROI indicates that over the solar panels’ lifetime, which is between 25 to 35 years, the money saved on electricity bills and earned through the panels will be greater than the initial investment cost.

To increase the life cycle of solar panels and ROI, energy management techniques are crucial. Below are a few techniques that can help effectively manage the system:

Battery Storage

Solar batteries can store excess energy, improving the efficiency of a solar setup by retaining surplus energy generated from the panels. This stored energy can be utilized during rainy days, reducing dependence on the electric grid.

Load Management

Load management refers to optimizing and controlling the distribution of electricity generated by solar panels to meet the energy demands of a home or facility. It involves monitoring and regulating the electricity consumption to ensure that the energy produced by the solar panels is used effectively and stored when there is excess.

Smart Energy Management Systems (SEMS)

SEMS are advanced technological solutions that integrate various components and devices to optimize the generation, consumption, and storage of energy in a more efficient and sustainable manner. These systems leverage data analytics, artificial intelligence, and real-time monitoring to achieve energy savings, reduce costs, and promote environmental sustainability.

Net Metering

Net metering is a billing arrangement or incentive offered by some utility companies that allows customers who generate their own electricity, typically through solar panels or other renewable energy sources, to receive credits for any excess electricity they produce and feed back into the grid.

Conclusion

As corporate sustainability becomes imperative, it is crucial for businesses and homeowners to evaluate their solar financing options to align with their energy goals and maximize their ROI. By leveraging these financing avenues, homeowners and businesses can not only contribute to a greener future but also secure economic benefits for years to come.

So, let us harness the power of solar energy and steer our homes and businesses toward a sustainable and prosperous tomorrow. Together, we can make a lasting impact on our planet and the bottom line.

Read about such innovative technologies and more in our blogs. Get solar industry updates through our industry news sections and don’t forget to subscribe to our monthly newsletter!